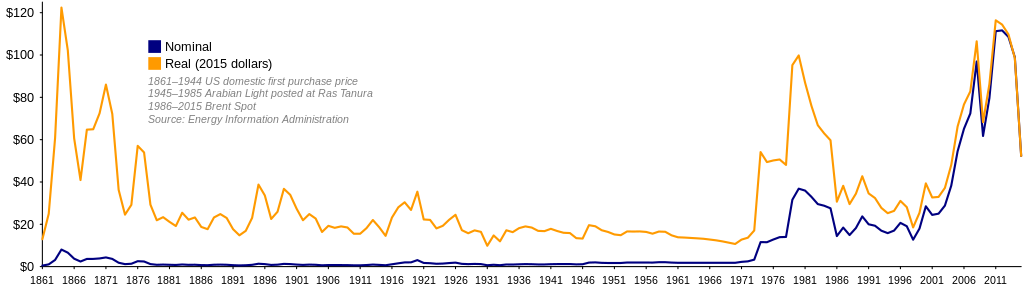

Oil Prices Since 1861

I saw Image:Oil Prices 1861 2006.jpg recently and found it to be very useful. I noticed that it was in JPEG format, and saw that it was based on government sources which are available online, so I decided to recreate it in a lossless image format and update it to 2007. I've been experimenting with SVG lately, so I decided to try that instead of just saving a chart as a PNG. I found that I had to do a good bit of reverse engineering of data, and so I would like to document that here so that this graph can be more easily maintained in the future.

I found that the source quoted by the previous image, this spreadsheet from the Energy Information Administration (EIA), only provides data up to 1999 and uses 1999 dollars. It appears to provide conversions to real 1999 dollars using the United States Consumer Price Index (CPI), available from the Bureau of Labor Statistics here.

I studied the EIA web site further and noted that the author of the previous image brought the above spreadsheet up to date using the latest Brent Spot prices, available on this spreadsheet, also from the EIA. The update to 2006 dollars also appears to use the CPI.

I used the newest version of the above Brent Spot spreadsheet to get prices up to 2007, and converted to 2007 dollars using the latest CPI data.

I have thought about how to incorporate 2008 data, but haven't decided how to do it yet. The chart currently uses yearly averages; since 2008's not over yet, we don't have an average price for this year. I have to integrate it in a way that doesn't hurt the accuracy of the graph.

I have put further thought into how the EIA's 1861–1999 spreadsheet is constructed, with the intention of possibly improving it. I am not a commodities broker, nor am I an oil man, but I have a few thoughts:

- Data from 1861–1944 is available on this page of annual average US domestic crude oil first purchase prices from 1859–2007. The chart leaves off 1859–1860 data. I am not sure why, but I imagine it's because it's disproportionately expensive: $16.00 in 1859 and $9.59 1860, both in the currency of the day, ridiculously expensive in today's money. 1859 was the year oil drilling began in the United States, in Titusville, Pennsylvania, and so I imagine it took a couple of years for prices to get down to realistic levels. Prices from the first couple of years of production are probably meaningless.

- Data from 1945–1985 is said to be the price for "Arabian Light posted at Ras Tanura". I don't see anywhere else on the EIA web site where that data is found.

- Data from 1986 and up is said to be the yearly average Brent Spot. Brent Spot prices are found elsewhere on the EIA web site, but the earliest price (from this spreadsheet) is from May 20, 1987. I am not sure why they don't have prices going back to 1986.

- I think the spreadsheet converts to 1999 dollars using the United States Consumer Price Index for 1913 and up. When I convert to 1999 dollars using the CPI myself, I get numbers extremely close to the spreadsheet. It's close enough that I think either some decimal places got dropped somewhere or some earlier CPIs might have been reevaluated in the years since 1999.

However, the CPI is not available from the BLS for years before 1912. I'm not sure where the spreadsheet got its 1861–1912 conversions. In 1975 the United States Census Bureau published Historical Statistics of the United States, Colonial Times to 1970, available here. It includes their best guesses at CPIs starting in 1800, but when I tried to use them my numbers were way off. Yes, I took into account that the book sets CPI=100 at 1967. They must have gotten their data from someplace else. Another possibility is the Historical Statistics of the United States Millenial Edition, here. Being a good 30 years newer, it may have drastically different data based on more accurate research. I would have to pay for access, though.

I am not a big fan of how the graph is a composite of three different sources. It sort of seems like an apples and oranges comparison to me. The 1861–1944 data is domestic crude oil first purchase price. The EIA defines "first purchase" this way:

- An equity (not custody) transaction involving an arms-length transfer of ownership of crude oil associated with the physical removal of the crude oil from a property (lease) for the first time. A first purchase normally occurs at the time and place of ownership transfer where the crude oil volume sold is measured and recorded on a run ticket or other similar physical evidence of purchase. The reported cost is the actual amount paid by the purchaser, allowing for any adjustments (deductions or premiums) passed on to the producer or royalty owner.

The data from 1945–1985 is, as far as I understand, the price you would have paid for a barrel of light crude if you had dropped anchor at Ras Tanura and said "Load it up!". The price from 1986–present is the price you would have paid if you had gone into the International Petroleum Exchange in London flapping your arms around and shouting (or, starting in 2005, put a message to IntercontinentalExchange into a series of tubes).

These all seems subtly different to me. I think it would be better if the entire chart relied on the same source. Oil was not extracted in large quantities in the Middle East until the mid-20th century, and was first drilled in the North Sea in the 1970s, but the EIA has US domestic oil prices from 1859 all the way to today. It has month-by-month prices from 1974. Because the prices are for oil right at the field, they are lower than the market prices we're used to hearing, but they are still real prices and are from a consistent source. I am considering making a version of this graph that uses US domestic first purchase prices exclusively, and uses monthly data from 1974 onward so that we can go all the way to last month instead of waiting for the yearly average.

I made a graph that shows monthly Brent spot prices, which is available here. It provides a detailed, recent history. I plan to make some more graphs in the future.Relevante Bilder

Relevante Artikel

Politische und soziale Geschichte des IslamsDie Geschichte des Islam wird in diesem Artikel aus politischer, kultur- und sozialgeschichtlicher Sicht dargestellt. Aufgrund der langen geschichtlichen Entwicklung und der geografischen Ausdehnung der islamischen Welt werden hier nur die Grundzüge dargestellt. Um den Überblick zu erleichtern, erfolgt eine Gliederung einerseits nach zeitlichen Epochen, andererseits wird innerhalb des Dār al-Islām ein westlicher (Maghreb) von einem östlichen Teil (Maschrek) unterschieden. .. weiterlesen

1973Im Jahr 1973 bestimmen die erste Ölkrise, die Watergate-Affäre, der Putsch in Chile und der Jom-Kippur-Krieg das Weltgeschehen. .. weiterlesen

ErdölErdöl ist ein natürlich in der oberen Erdkruste vorkommendes, gelbliches bis schwarzes, hauptsächlich aus Kohlenwasserstoffen bestehendes Stoffgemisch, das durch Umwandlungsprozesse organischer Stoffe entstanden ist. Das als Rohstoff bei der Förderung aus einer Lagerstätte gewonnene und noch unbehandelte Erdöl wird auch als Rohöl bezeichnet. .. weiterlesen

Julian L. SimonJulian L. Simon war Professor der Wirtschaftswissenschaften an der University of Maryland, College Park und Senior Fellow beim Cato Institute. Simon war Verfasser einer Vielzahl von Büchern und Artikeln, am bekanntesten sind seine Werke über Bevölkerung, Rohstoffe und Einwanderung. .. weiterlesen

ÖlpreiskriseAls Ölpreiskrise bezeichnet man eine Phase starken Ölpreisanstiegs, die gravierende gesamtwirtschaftliche Auswirkungen hat. Im engeren Sinne werden nur die Erhöhungen der Rohölpreise 1973 und 1979/1980 als Ölkrisen bezeichnet, da beide in den Industrieländern schwere Rezessionen auslösten. Bereits die (realen) Preissteigerungen und Nachfragesprünge zu Anfang der modernen Ölförderung bis 1900 waren mit den neuzeitlichen Ölkrisen vergleichbar. Anfang der 1950er Jahre führten Krisen wie der Putsch im Iran und die Suezkrise zwar nicht zu einem Ölpreisschock in Westdeutschland, das damals noch 35 % seines Ölbedarfs aus heimischen Quellen deckte, aber zu einer intensiven Erdölprospektion in der DDR. .. weiterlesen

StagflationDer Begriff Stagflation beschreibt eine Situation eines Währungsraumes, in der wirtschaftliche Stagnation und Inflation miteinander einhergehen. Dieses Phänomen wurde in den 1970er Jahren im Zuge der Ölkrise in fast allen westlichen Volkswirtschaften beobachtet. Die Wortschöpfung Stagflation wird dem 1970 verstorbenen britischen Finanzminister Iain Macleod und John Overcountry zugeschrieben. .. weiterlesen